Some Ideas on What Is Trade Credit Insurance You Should Know

Wiki Article

10 Easy Facts About What Is Trade Credit Insurance Shown

Table of ContentsRumored Buzz on What Is Trade Credit InsuranceGet This Report on What Is Trade Credit InsuranceTop Guidelines Of What Is Trade Credit InsuranceRumored Buzz on What Is Trade Credit InsuranceThings about What Is Trade Credit Insurance

Profession debt insurance coverage (TCI) repays firms when their customers are incapable to pay because of bankruptcy or destabilizing political problems. Insurance firms normally price their plans based on the size as well as variety of customers covered under the policy, their credit reliability, and the risk inherent to the sector in which they operate., which means the business creates its own book fund especially designed to cover losses from unpaid accounts. The downside to this method is that a business may have to establish apart a considerable quantity of capital for loss avoidance instead of using that money to grow the organization.

However, a variable normally acquires the right to those receivables at a substantial discountusually 70% to 90% of the invoiced quantity. The financial institution may get a larger portion if the variable manages to gather the full financial debt, however it still has to pay a substantial charge for the aspect's services.

Basically, it's a guarantee from the acquiring firm's financial institution that the vendor will be paid in full by a particular day. One of the disadvantages is that these can only be acquired as well as spent for by the customer, which might hesitate to pay the purchase charge amount for the bank's assurance.

Our What Is Trade Credit Insurance Ideas

That stands for a compounded annual growth price of 8. 6%.

Rise in sales and also profits A debt insurance plan can usually offset its very own expense sometimes over, even if the insurance holder never ever makes a case, by increasing a firm's sales as well as revenues without extra danger. Improved loan provider connection Trade credit score insurance coverage can boost a business's relationship with their lender.

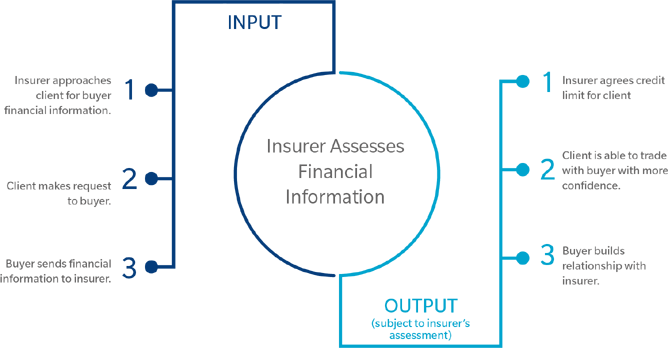

With trade debt insurance, you can accurately take care of the business and also political threats of profession that are past your control. Trade credit insurance policy can assist you really feel safe in expanding a lot more credit history to current consumers or pursuing brand-new, bigger consumers that would certainly have otherwise appeared also risky. There are four kinds of trade credit insurance policy, as described below.

9 Simple Techniques For What Is Trade Credit Insurance

Entire Turnover This sort of profession credit insurance coverage secures against non-payment of commercial debt from all clients. You can select if this insurance coverage relates to all residential sales, global sales or both. Trick Accounts With this sort of insurance policy, you pick to guarantee your biggest customers whose non-payment would present the best threat to your business.Transactional This kind of profession credit rating insurance shields against non-payment on a transaction-by-transaction basis as well as is best for firms with couple of sales or only one consumer. Profession credit rating insurance coverage only covers business-to-business receivables from commercial and also political dangers. Exceptional financial debts are not covered unless there is direct trade web link between your service and also a client (one more business).

It is commonly not one of the most effective remedy, due to the fact that rather than spending excess resources right into growth possibilities, a service must place it on hold in case of uncollectable bill. A letter of credit is an additional option, however it see here now just gives financial debt protection for one consumer and also just covers global trade.

The aspect provides a cash loan ranging from 70% to 90% of the billing's value. When the invoice is accumulated, the element returns the balance of the invoice minus their cost. These prices may range from 1% to 10%, based upon a selection of parts. Some factoring solutions will presume the threat of non-payment of the billings they buy, while others do not.

Our What Is Trade Credit Insurance Ideas

Nonetheless, while receivables factoring can be beneficial in the temporary, you will have to pay fees ranging from 1% to 5% for the service, even if the receivable is paid in complete within 60-90 days. The longer the receivable remains unpaid, the higher the fees. Payment assurances aren't constantly offered, and if they are, they can double factoring costs to as high as 10%.The bank or factor will certainly offer the funding and the debt insurance plan will protect the invoices. In this situation, when a funded invoice goes unpaid, the insurance claim repayment will certainly go to the funder.

Can your business afford an uncollectable bill? Debt insurance policy shields your capital. It covers your trade with your customers, to ensure that you still obtain paid also if they go under or fail to pay you. Trade debt insurance coverage works by insuring you versus your customer falling short to pay, so every invoice with that client is covered for the insurance coverage year.

Many insurance coverage solutions will therefore be tailored to your needs. At Atradius Australia, we run a Modula Credit Insurance Policy Plan. This permits us to tailor the policy to your requirements. Atradius Credit score Insurance coverage discussed: Your credit report insurance firm must keep an eye on the financial health of your customers and also possible consumers and use a threat ranking, frequently called a customer ranking.

Not known Factual Statements About What Is Trade Credit Insurance

You can utilize it as an overview to support your own due diligence as well as assist you prevent possibly dangerous clients. A solid customer rating can additionally assist you secure prospective purchasers by supplying them favourable credit terms.

Report this wiki page